Stoks

- Closed at 175.05 after hours from last week of 170.80

- Share price went to highs of 184.25 as EM decided to give 1 month of FSD trial to new buyers.

- Markets liked the news but wasn't strong enough to hold the 180 resistance.

- Deliveries will come out over the weekend but nothing much to expect given last few Qs.

- Main thing is to look at earnings in 3 weeks time, if there are big green days, can try some puts.

- Took some losses on NVDA options and went fully on QQQ puts.

- DXY was favorable as well so changed some USD back to SGD to lock in 1.3468.

- Effectively changing from 1.341 to 1.334 to 1.3468, getting some HK itchy finger losses back.

- SG banks almost had a fantastic week with DBS almost reaching back ath but closed at 36.03.

- Looked like some profit taking happened on the last day of the short week.

- Will dca bank once ex dividend next Thur, hope to see some more discounts prior to then.

- So far earning some peanuts on my 100 shares of QQQ, 85.88 for this week not too bad.

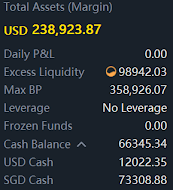

US P/L 271015.96

SG P/L 33029.89

Down-ed ~1.8K ftw

1.3448

87878.32 SGD (57.51)

569500.67 USD (500.67)

Life

- Decided to offload some of my watches, BB58 down for 180.

- 3 more to go if the prices are right.

- Weather is horrible, average 32C everyday. No signs of rain omg...pkl