Stoks

- Good year for STI esp local banks which all 3 rallied more than average 27, 28 and 44% for the year.

- Reits are still lagging behind as rate cuts are expected to slow down or even reduce as inflation stays sticky.

- With trump taking over in 3 weeks, inflation is bound to come back high give he plans to cut rates and turn on the money printer.

- US performance was low compared to SG portfolio due to my constant buy and sell but surprisingly managed to beat SPY but not QQQ.

- November was a good month for stock market after trump won the election, sending a massive pump to stocks and crypto related to him.

- TSLA went back to aths and reached high of 488 before losing steam, no time for hindsight 20/20, will laugh if it goes back to 200 and those long term investors lost all their gains.

- BTC broke previous highs and went to 107 before closing at 93 this year, seems like a 3year bear every cycle before making new highs. Luna vesting is completed.

- Given how markets are seemingly expensive and many are calling for a crash this coming year, doubt it will happen and we will still see a green year again.

- If not, will slowly dca 2K max every week for 30 weeks if it so happens to have a consecutive 30 down weeks.

- Going QQQM and VGT for peace of mind and exposure to US markets. Some IBIT for why not.

- Hearsay DBS and OCBC to increase div this year and possibly a special payout for the latter.

- Still have around 40K for SGD bullets, hoping banks can increase div so I can lock in the gains without having to sell the stock to realize the gains.

- Received a letter from Singlife saying first payout for MyLifeIncome will be on the start date of every policy year which is Mar and Aug.

- Upcoming payout will be 1922 which happens to be 3.7% annualized based on premiums paid.

- Should things go south, will cancel the policy since capital is guaranteed and SV is officially more than premium paid.

- Here's wishing to have a 'good' market for 2025.

Life

- Biggest update would be, got my first gen 16570 'D' serial for my 30th this year on Nov.

- What an irony give that I told myself no luxury goods motto last year.

- So far largest amount paid for something which can only be used by 1 person at any point in time.

- Went into local rep tele group, managed to clear one of my Omejas and traded the AP for a Hulk.

- 6 reps bought this year, best value would be the starbucks. Would have saved alot more if I knew about Andiot/Necoclock.

- Sold all my chinese watches for a loss as expected.

- Looking forward to another purchase in 2025 if all goes well and I hit the 2nd milestone of 1.5m pf value size.

- Other than watch purchase, no large ones were done. Bought a new redmi and managed to get silver for previous and current window.

- Next one will start on Aug this year but should be no issues if I continue the weekly runs.

- ICT in 12 days, good time to chill with familiar faces again.

- Have the feels to learn Korean to sing K songs and also do braces for 2025's resolution.

- Lesser styes for this year, total of 5 hope to keep the number to 3 this year and aim to get lesser over time.

- Jan, June, Sep, Oct, Dec.

- Car is left with 13 months before scrap, next update will be me starting to view a parf Avante from 2020.

- Left with about 7 mths about Burden Wang moves out.

- Stopped climbing as well for this year, left with 7 payments for AIA life policy.

- Investment interest from trader fren has ended, remaining 3K still in progress with pri sch fren.

- Wishing for a healthy 2025 for families and friends...

1/1/24 to 31/12/24 rough estimate

Dividends 2024 reference

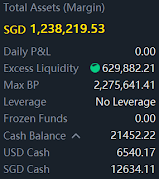

2024 Closing

2023 Closing

236850.21 SGD Deposit

Withdrew 25100 in total

Overall good year

R+UR P/L $287602.71

35030.23 USD MMF, 1.3551