Stoks

- TSLA missed earnings and share price tanked to 220 as of Fri's close.

- Lost about 1K USD from betting on the direction of the movement.

- Should have just followed my instinct of buying calls and puts rather than betting straight on 1.

- Would have earned at least 200 on a 900 capital.

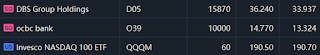

- Sold off TSLA and rebought 11K worth of QQQM, opened IBKR and dca into new holdings such as CSPX and adding QQQM n MAG.

- Will be considering to add FB if the share price gives some discount.

- DBS lost almost all of its gain since the pump in the last week of June, preparing to whack more once yield starts hitting 6% soon.

- TBH the capital gains doesn't matter as long it is able to maintain and increase the yield over time.

- So far last purchase of 800 shares at average of 36.88 which is still decent at 5.85%.

- Remaining sum of 356K to be used for monthly IBKR DCA of 2K SGD and D05.

US P/L 264210.56

SG P/L 53078.16

Down-ed approx 10.6K SGD.

333213.70 SGD, subscribed 70K

1.3383 USD FX

Withdrew 20K SGD to fund IBKR

Bought 300 DBS n 60 QQQM

66.03% Banks

1.4% US Tech

1.4% US Tech

32.57% Cash

Life

- Last IPT for this cycle before new one begins next Sat, will be going once per week for 10 weeks to max out effort pay.

- Met secondary sch fren on Thur's session, looks like he's doing good.

- Deciding whether to buy a silver OP36 for my new 'last' collection but kept thinking about the bloody opportunity cost.

- It doesn't hurt the pocket but why is there a big contemplation?...pkl