Stoks

- TLDR, CCP decides to use their money printer for the economy, cutting rates, asking banks to lend more and giving cash to citizens to spend.

- Entire CN/HK market rallied doubled digits, BABA broke 100 and PINGAN went from 37 to 48 in a week.

- Was contemplating to get PA but decided not to due to the lower div payout, turns out it was a big mistake lol.

- Too bad, you didn't miss the boat if you weren't planning to board it in the first place.

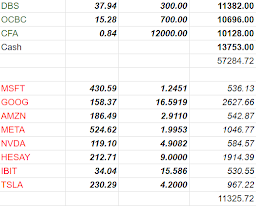

- DBS lost almost 4% since the last week as I feel BB may have started to move funds into China prior to the upcoming QE there.

- Bought almost 20K of banks and 12K of Link this week.

- Entered new position into VUAA in IBKR, started dca every 2nd of the month from upcoming week.

- Left with around 10% cash in Tigers, will slowly start CSP plays on TSLA/NVDA.

- Will hold on to cash abit tighter from now.

US P/L 264234.44

SG P/L 108656.51

HK P/L 187693.16

IBKR C57993.72 $60034.73

Down-ed approx 30K for Tiger, 0.14K for IBKR

Redeemed entire SGD MMF

1.2758 USD FX, still depreciating

+400 DBS, 500 OCBC

+2000 LINK

Life

- Wanted to start daily 2.4km run, failed on the first day.

- Managed to start on the second day only to get a stye on the right from the next day.

- Stopped all forms of exercise since Wednesday, bloody good timing.

- Cancelled my IPT training as well, subscribed for Grab promo...pkl