Stoks

- Generally good week for both US and SG markets.

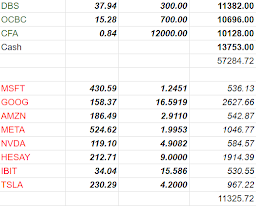

- Perhaps markets are moving up in expectations to the 0.25 rate cut next week and funds are moving to lock in the div yields in Asia markets.

- Bought into Link Reit after considering the fact that it's a large position in CFA and the low gearing compared to usual S-reit.

- Yield is good at mid 6%, only thing to consider is the fx risk of HKD to SGD.

- Bought TSLA, HESAY and IBIT just to add some colours to the PF.

- Up almost 4% for DBS alone in the past week since better to lock in mid 5% first before fed cuts.

- Still have more than 15% Cash for standby, while 13% is earning the low 3s in MMF.

- PF is slowly inching up to the 1.2m mark, hopefully we can see it breach soon.

- Really roller coaster ride for the banks, 38.55 to 32.75 and back to 37.93.

- Best not to time and buy dips whenever they come so long the movements are from noise and not fundamentals.

- Doubt that I can do another timing tbh.

US P/L 264200.22

SG P/L 117003.52

HK P/L 181143.40

IBKR C57500 $60034.73

Up-ed approx 35K SGD for Tiger, 1.6K SGD for IBKR

140620.70 SGD, withdrew 18K from MMF

1.2943 USD FX

+2000 shares of 0823

Bought the dip on GOOG and META

Life

- Went for IPPT for BFCC, met a mutual friend and got silver each so extra $300.

- Managed to hit under 12m for a long time since then.

- As usual, ez for push ups, surprised to hit 58 with almost 15 to 20s remaining iirc.

- No excuse for sit ups, planks definitely don't help in endurance.

- Thinking to get another BPF 16613 or shall I get a Garmin for running...pkl

No comments:

Post a Comment