Stoks

- Legend says there's this 3 day rule after earnings where the stock will continue to go up/down depending on the results.

- For TSLA's case after its results on wed, the 'correction' continued on Mon with prices reaching as low as 254.12.

- Surprisingly, buyers came in and ended the day at 269 which was unexpected as majority were saying back to 240s.

- Share price was relatively flat, Fed increased another 0.25% and at this point the market doesn't seem to care anymore which is good for investors.

- Thurs had a large sell off probably due to the fed rate increase which seems the lag-effect after every fed decision.

- However, on the last day of trading, everything went back to normal although TA traders saw a bearish engulfing candle and market closed higher for the week.

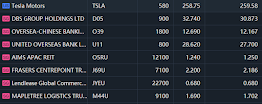

- DCA-ed a little more on SG stocks for the dividend play, joined this tele group where I leech off many OG div investors.

- Bought 20 more TSLA on thur morning but didn't manage to take advantage when it went back to 255, damn.

- Current IV is getting lower each week, will be forced to sell csp at prices which I may not want to own at.

- Still left with more than 60% cash on hand and tbh market very excited now, not feeling the mood to buy.

- Good week for SG banks, will rebuy once ex div date is announced and TSLA closed at 266.44.

Recovered some UR gains, RG of 1573.78 USD

UR gains increased by ~4.1K

Put 150K USD in 5% TV while selling monthly puts for that locked amt

Life

- Burden Wang has inflammatory bile according to vet, will have to change diet to the expensive kibble. No more cooked food and old kibble.

- Contemplating to get a car but at 1.66K per month averaged out or unless an OPC or a see luck COE car?

- Watched MI7 with TBL, Tom cruise really no horse run. Part 2 will release in one year's time, looking forward to it...pkl