Stoks

- Market expected deliveries not to beat, TSLA managed to beat.

- Market expected earnings to beat, TSLA managed to beat but at the cost of lower gross and operating margins as a 'car' company.

- Share price rose to highs of 299 on Wed but closed at 291, fomo-ed in and the rest is history.

- Initial thoughts were expecting earnings to miss but got influenced by share price since previous NVDA was red before doing the 20% AH jump.

- Together with the way EM spoke to the market, it clearly didn't understand a Martian way of speaking thus confusion equals sell off.

- Share price closed at 280 AH, sold down to 262 on Thurs and closed at 258 AH on Fri.

- Mistakes were made, got greedy and didn't hedge with puts for the 3rd earnings, big lesson.

- No more options during earnings week and HHH.

- From last week profits, gave back 28K USD including UR gains based on numbers on TB.

- Together with the new Nasdaq rebalancing rule, sell down definitely had something to do with the rule. Mon may sell another sell down as people starting to cut loss.

- Profits lost also due to rolling of options downwards, will stop at 1.5K shares max unless prices go below 200.

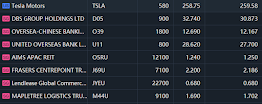

- Allocating remaining back to reits and banks, bought UOB, AIMS, FCT, LREIT and MLT this week.

- Holding 580 shares at 259.58.

Down-ed 28.3K URG and RG but fx recovered some pf value

Up-ed 1.7K URG due to good timing for UOB purchase

Life

- Burden Wang is experiencing some body issues, hopefully he can recover asap.

- Made up mind to get a 2yr elantra around 2yrs + but too bad, car has been bought by someone else.

- 1 more mth for remaining lease of car, let's see whether any fate towards a car of similar specs.

- Tried to service the aircon but damn not worth the time...pkl

No comments:

Post a Comment